What are the factors affecting HDB resale prices?

HDB resale prices are influenced by a complex interplay of factors, and understanding these can provide valuable insights for both buyers and sellers. Beyond the general market sentiment and economic conditions, several specific attributes of an HDB flat and its surroundings significantly impact its value.

Here's a more in-depth look at some key factors:

1. Proximity to MRT stations: This is a major determinant of HDB resale prices. The closer a flat is to an MRT station, the higher its value tends to be. This is due to enhanced connectivity and convenience, reducing commute times for residents.

Properties within a 5-10 minute walk (approximately 400-800 meters) of an MRT station can command a significant premium, often 10-20% higher than comparable units further away. The premium can be even more substantial for units right next to an interchange station, offering access to multiple lines.

While closer is generally better, there can be a point of diminishing returns. Extremely close proximity (e.g., directly opposite an entrance) might bring some noise pollution, which could slightly offset the convenience factor for some buyers, though this is usually minor. The specific MRT line also matters; lines with more extensive networks or serving key employment hubs (like the North-South or East-West lines) can confer a greater advantage.

2. Proximity to malls and retail hubs: Access to amenities like shopping malls, supermarkets, food courts, and entertainment options significantly enhances a flat's appeal. Flats located within easy walking distance (e.g., 5-15 minutes) of major malls or vibrant town centres often see a price uplift. This convenience translates to less travel time for daily necessities and leisure activities.

The type and size of the mall matter. A large, comprehensive mall with a wide array of offerings will have a greater positive impact than a small, neighbourhood retail cluster. The presence of popular supermarkets, childcare facilities, and clinics within or near the mall further adds to its attractiveness. Some buyers might even pay a premium for being near a mall that offers unique experiences or popular dining options.

3. Age of the flat and remaining lease: This is a fundamental factor. HDB flats are sold on 99-year leases, and as the lease dwindles, the property's value generally depreciates. Newer flats with a long remaining lease typically command higher prices due to their longer economic lifespan. Flats with less than 60 years remaining on their lease can become harder to sell, as banks may offer lower loan quantum and CPF usage restrictions kick in, limiting the pool of potential buyers.

While older flats generally see depreciation, a well-maintained older flat in a prime location with good access to amenities might still hold its value relatively well compared to a newer flat in a less desirable area. There's also a segment of buyers who prefer older, larger flat layouts, which are less common in newer developments.

4. Flat type and size: The number of rooms and the total floor area directly correlate with price. Generally, larger flats (e.g., 4-room, 5-room, Executive Maisonettes) are more expensive than smaller ones (3-room, 2-room). This is due to the greater living space they offer.

There can be exceptions. For example, a highly sought-after 3-room flat in a mature estate with exceptional connectivity might command a higher price than a 4-room flat in a less accessible, non-mature estate. The efficiency of the layout also plays a role; a well-designed layout that maximises usable space can be more appealing than a poorly configured larger flat.

5. Floor level and facing: Higher floor units generally command a premium due to better views, more privacy, and less noise. Units with unblocked views (e.g., facing a park, sea, or city skyline) are more desirable. North-South facing units are often preferred as they receive less direct sun exposure, leading to cooler interiors. While high floors are generally preferred, some buyers might specifically seek out lower floors for easier access or for those with young children/elderly family members. Specific block orientation can also impact sun exposure at different times of the day, which can be a consideration for some.

6. Renovation and condition: The state of the flat can significantly impact its appeal and price. Well-renovated flats that are move-in ready can command a higher price as buyers save on renovation costs and time. Conversely, a flat in poor condition requiring extensive renovation will likely fetch a lower price. The style and quality of renovation matters a lot. A timeless, well-executed renovation is generally preferred over overly specific or dated designs. Sometimes, a "blank slate" flat (minimal renovation) might appeal to buyers who want to customise it entirely to their taste, as long as the price reflects the renovation cost savings for the buyer.

7. Proximity to schools: For families with school-going children, proximity to good primary schools is a significant factor. Being within the 1km or 2km radius of popular primary schools can add a premium to HDB flat prices, especially for families looking to secure a spot for their children through the balloting system. The "popularity" of schools can change over time, so while a school might be desirable now, its long-term appeal can fluctuate. Also, secondary schools and tertiary institutions can also have a minor impact, though primary school proximity is generally the most significant educational factor.

8. Estate maturity and amenities: Mature estates (like Ang Mo Kio, Toa Payoh, Queenstown) often have more established amenities, better public transport networks, and a stronger sense of community. Flats in mature estates generally command higher prices due to their well-developed infrastructure, amenities, and often, more central locations. Non-mature estates are catching up rapidly with new amenities and infrastructure. While they might start at a lower price point, they can offer greater potential for capital appreciation as the estate develops and matures.

Latest HDB resale price trends (Updated in Jul 2025)

HDB resale prices inched up by 0.1% in June 2025, continuing the plateauing trend seen over the past couple of months. The biggest movement came from 5-room flats, which saw prices rise by 0.8%. 3-room flats also recorded a 0.4% increase. In contrast, 4-room flat prices held steady, while Executive flats took a hit with a 2.7% drop.

Prices in non-mature estates crept up by 0.1%, while those in mature estates remained flat, a pattern that’s becoming more common as more buyers turn to emerging neighbourhoods for better value.

Compared to the same period last year, HDB resale prices are still on solid footing, up by 7.3% year-on-year. Every flat type saw gains: 3-room flats rose by 8.6%, 4-room by 7.7%, 5-room by 6%, and Executive flats by 6.1%. Prices in mature and non-mature estates climbed equally by 7.2%, reflecting broad-based demand.

Transaction volumes dipped slightly to 2,276 in June, just 0.4% lower than May. But that's not out of the ordinary, given June tends to be quieter with school holidays and agents taking breaks. Still, the year-on-year numbers tell a different story: volumes were up by 4.2% from June 2024.

4-room flats continued to dominate the market, making up 43.1% of transactions. 3-room and 5-room flats followed with 26.2% and 24% respectively. Executive flats remained a niche segment, contributing just 6.7% of sales.

Notably, 58.5% of all resale deals came from non-mature estates; another sign that more buyers are prioritising space and affordability, even if it means moving further from the city.

HDB resale price forecast for 2025

After a significant 8.6% surge in 2024, doubling the 4.2% growth of the previous year, HDB resale prices are anticipated to continue their upward trajectory in 2025, albeit with potentially more moderate growth. Several key factors could shape the market:

- Interest rate impact: An expected decline in SORA (Singapore Overnight Rate Average) rates could improve mortgage affordability. If private property mortgage rates drop below the HDB concessionary loan rate (currently 2.6%), some buyers might consider private condominiums, potentially moderating the demand for high-priced HDB resale flats.

- BTO supply & market shift: The completion of numerous BTO projects is set to inject new housing options into the market. This increased supply of subsidised flats could attract buyers, leading to a slight shift in demand away from the immediate resale market and potentially tempering rapid price gains.

- Strong demand for spacious units: Large HDB flats, particularly Executive (EXE) units, are expected to remain highly desirable. Limited supply combined with strong demand from upgraders and multi-generational families is likely to keep prices elevated for these spacious homes.

- Limited MOP supply: 2025 is projected to see one of the lowest numbers of newly Minimum Occupation Period (MOP)-ed flats entering the resale market in recent years. This supply constraint could contribute to sustained price levels, potentially favouring sellers.

- Private property market growth: While HDB prices are expected to hold strong, declining interest rates might slightly favour the private property market, particularly for buyers who find condos in a comparable price range to larger resale HDB flats.

Will million-dollar HDB flats hold their appeal in 2025?

In 2024, the number of million-dollar HDB transactions doubled, particularly in central locations like Kallang/Whampoa, Toa Payoh, and Bukit Merah. However, 2025 may present new challenges for these high-value transactions:

- More buyers may opt for private properties: With potential interest rate cuts, the appeal of condominiums could rise, drawing some buyers away from high-end HDB resale flats.

- Lease decay concerns: Some buyers may reassess whether it makes sense to pay over S$1 million for an older HDB flat with a shorter remaining lease when they could opt for a private condo with better long-term investment potential.

Unique flats may retain value: Not all million-dollar flats will be affected equally. HDB terraces, jumbo flats, and executive maisonettes – especially those in well-connected areas – are likely to hold their value due to their rarity and appeal to niche buyers.

Beyond the forecast

While forecasts provide a general outlook, it's crucial to consider location-specific trends and market fluctuations. Regularly monitoring resale data from HDB and established property agencies can equip you with the most up-to-date market insights for informed decision-making.

Here's what you can do to keep up with the latest HDB resale price numbers:

- Monitor market data: Keep an eye on our HDB resale price data releases and reports to track actual price movements in your desired location.

- Focus on location trends: Price changes might vary by area. Research specific locations you're interested in to understand their historical price trends and potential future movement. You can do this by keeping track of our HDB estate pages.

- Consult a valid property agent: A good property agent can provide valuable insights into the current market climate and specific flat valuations, helping you make informed decisions.

HDB Resale Median Prices

The HDB resale flat median prices are based on the fiftieth percentile for each type of flat in every HDB town and are consolidated every quarter. Accordingly, half of the flats that were transacted had prices higher than the median, and half had prices lower than the median.

Singapore median HDB resale prices

| Estates/Towns | 3 Room | 4 Room | 5 Room | Executive |

|---|---|---|---|---|

| Ang Mo Kio | - | - | - | - |

| Bedok | - | - | - | - |

| Bishan | - | - | - | - |

| Bukit Batok | - | - | - | - |

| Bukit Merah | - | - | - | - |

| Bukit Panjang | - | - | - | - |

| Bukit Timah | - | - | - | - |

| Central | - | - | - | - |

| Choa Chu Kang | - | - | - | - |

| Clementi | - | - | - | - |

| Geylang | - | - | - | - |

| Hougang | - | - | - | - |

| Jurong East | - | - | - | - |

| Jurong West | - | - | - | - |

| Kallang / Whampoa | - | - | - | - |

| Marine Parade | - | - | - | - |

| Pasir Ris | - | - | - | - |

| Punggol | - | - | - | - |

| Queenstown | - | - | - | - |

| Sembawang | - | - | - | - |

| Sengkang | - | - | - | - |

| Serangoon | - | - | - | - |

| Tampines | - | - | - | - |

| Tengah | - | - | - | - |

| Toa Payoh | - | - | - | - |

| Woodlands | - | - | - | - |

| Yishun | - | - | - | - |

Table reflects median price in Jan 2025. Data is updated on 01 Feb 2025 and is derived from the 99.co database.

- (-) indicates no resale transactions in the month

- Asterisks (" * ") refer to cases where there are less than 20 resale transactions in the month for the particular town and flat type. The median prices of these cases are not shown as they may not be representative

Should you buy Resale HDB or BTO?

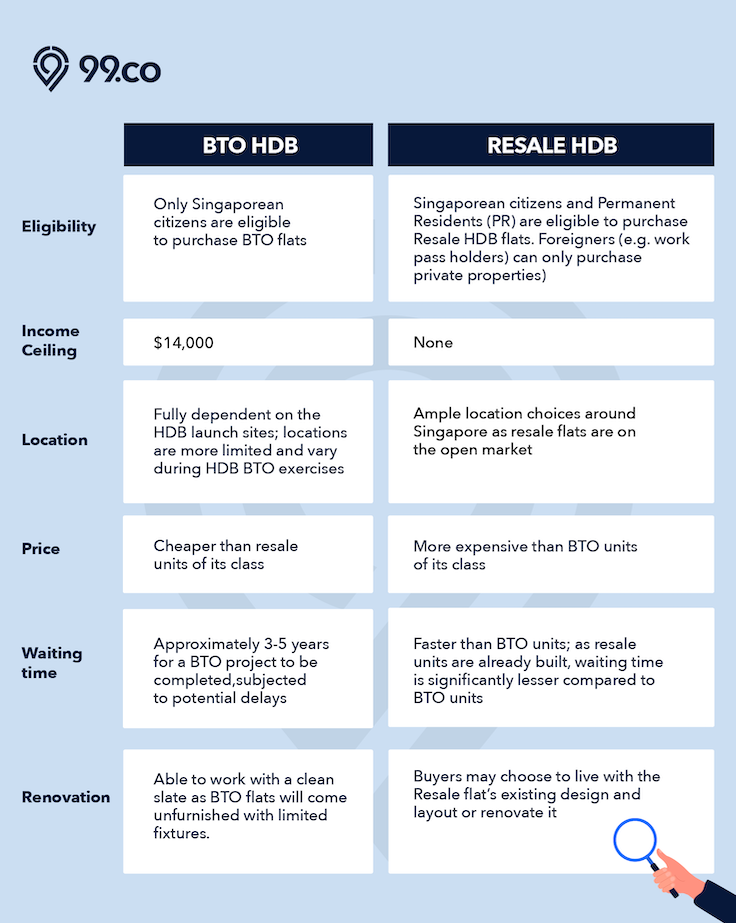

There are several differentiating factors between BTO and Resale HDB flats. Here are some key differences to help you find out which type is right for you.

A comparison between BTO and Resale HDB flats

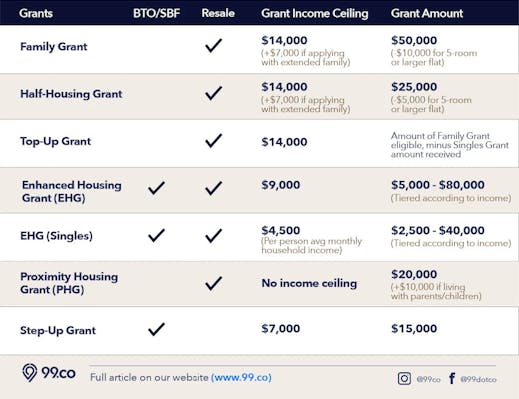

Types of HDB Resale Grants

HDB resale grants will vary depending on several factors, as first-timers, singles and families will be eligible for different grants. Some examples of HDB grants are the Family Grant, Enhanced Grant and Top Up Grant, among others. As the income ceiling has been raised for the CPF Family Grant from S$12,000 to S$14,000, the highest possible grant amount that resale buyers can get will be up to S$160,000.

Different types of HDB grants

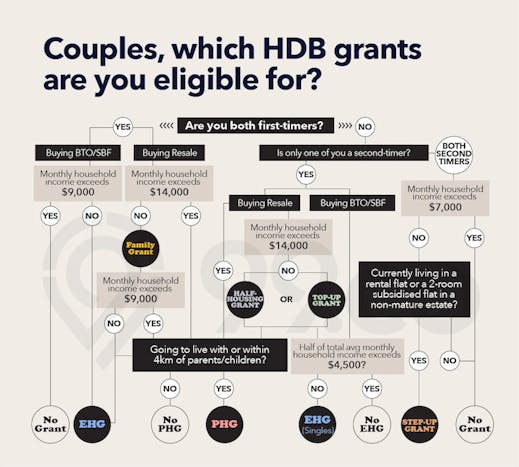

For couples, refer to this chart to see what are the grants that you are eligible for to increase your savings on your next HDB flat purchase.

A flowchart of various HDB grants available for couples

HDB Flat Eligibility (HFE) Letter for HDB Resale flat application

Since 9 May 2023, HDB has introduced the HDB Flat Eligibility (HFE) letter which assesses your eligibility to buy an HDB resale flat, receive HDB grants and take up the HDB housing loan. Previously, the eligibility on these three aspects was assessed at different stages, but now they will just be assessed once.

The HFE replaces the HDB Loan Eligibility (HLE) letter, which you’d previously need before you get an Option to Purchase (for a resale flat).

The HDB Flat Eligibility (HFE) letter will inform you of your eligibility:

- To buy a new and/or resale flat

- Receive CPF grants, including the amount

- Get HDB housing loan, including the loan amount

For resale HDB flats, you’ll need to apply for the HFE before getting an Option to Purchase (OTP) from the seller, and before submitting the resale application.

Editor’s note: This is a recurring post, regularly updated with new information. Last Updated 8th Jul 2025.

Resale HDBs in Popular Areas

- HDBs for Sale in Bukit Batok

- HDBs for Sale in Hougang

- HDBs for Sale in Sembawang

- HDBs for Sale in Bukit Panjang

- HDBs for Sale in Woodlands

- HDBs for Sale in Geylang

- HDBs for Sale in Pasir Ris

- HDBs for Sale in Clementi

- HDBs for Sale in Toa Payoh

- HDBs for Sale in Bedok

- HDBs for Sale in Central Area

- HDBs for Sale in Kallang/Whampoa

- HDBs for Sale in Bishan

- HDBs for Sale in Bukit Timah

- HDBs for Sale in Choa Chu Kang

- HDBs for Sale in Jurong East

- HDBs for Sale in Jurong West

- HDBs for Sale in Marine Parade

- HDBs for Sale in Punggol

- HDBs for Sale in Queenstown

- HDBs for Sale in Sengkang

- HDBs for Sale in Serangoon

- HDBs for Sale in Tampines

- HDBs for Sale in Tengah

- HDBs for Sale in Yishun